I uploaded the text of the BBB into Chat GPT and started asking some questions. I’ve tried to format this in such a way that your eyes can quickly locate where one answer ends and a new question begins.

You can search the list of headings to jump to the topic you’re interested in. Then call your senator to tell them what you think of it!

Effects on Healthcare

Ice Raids and citizens protection from ICE harrassment

Workplace safety

Impact on parks

Opportunities for rich people to get richer

Government Grievance

Who benefits the most and who is harmed the most

What is a Trump account

Effects on Healthcare

If this bill is passed, how will it affect healthcare in America? Provide an executive summary and a bulleted list of pages that support your conclusion.

Executive Summary: Healthcare Impacts of the "One Big Beautiful Bill Act"

This conversation analyzed the potential effects of the One Big Beautiful Bill Act on healthcare in the United States, based on the contents of the bill. The bill introduces substantial reforms across Medicaid, Medicare, and tax-based healthcare subsidies. The key findings are:

Medicaid eligibility will be more strictly enforced, with increased redeterminations, exclusion of undocumented immigrants, and mandatory work/community engagement requirements.

Federal Medicaid funding will be reduced through the phase-out of enhanced matching rates (FMAP), restrictions on permissible uses of funds, and tighter budget controls on demonstration projects.

Medicare coverage will be narrowed, limiting eligibility for certain legal residents and excluding more drugs from Medicare price negotiations.

Premium tax credits (ACA subsidies) will be harder to qualify for, especially for undocumented immigrants and individuals who fail eligibility verification.

Expanded access to telehealth and direct primary care services is encouraged through favorable tax treatment and insurance regulations.

Rural healthcare access may improve via targeted support programs.

Relevant Pages in the Bill

Below is a list of the most relevant pages in the bill and the topics they cover:

Medicaid Eligibility and Access Restrictions

Page 638 – Moratorium on rule easing Medicaid/CHIP enrollment (§71102)

Pages 639–640 – Removal of duplicate and deceased enrollees (§71103–71105)

Pages 644–645 – Tightened eligibility for long-term care and non-citizen restrictions (§71108–71109)

Page 671 – Mandatory work/community engagement for certain Medicaid recipients (§71121)

Medicaid Funding Limitations

Page 666 – Prohibits Medicaid funding for certain services/entities (§71114–71115)

Page 668 – Ends enhanced FMAP incentives (§71116)

Page 669 – Requires budget neutrality for Medicaid demonstration projects (§71120)

Medicare Coverage and Payment Changes

Pages 715–716 – Restricts eligibility for Medicare to certain legal statuses (§71201)

Page 717 – Temporary physician fee schedule increases (§71202)

Page 718 – Excludes more orphan drugs from price controls (§71203)

Healthcare Tax Credit Reforms

Pages 723–724 – Restricts premium tax credit access based on immigration and Medicaid status (§71301–71302)

Pages 729–730 – Removes cap on recovering overpaid tax credits from recipients (§71305)

Telehealth and Direct Primary Care Support

Page 735 – Permanent safe harbor for telehealth in high-deductible plans (§71306)

Pages 736–738 – Favorable treatment of direct primary care arrangements for tax purposes (§71308)

Ice Raids and citizens protection from ICE harrassment

You said:

If this bill is passed, what effect will it have on ICE raids currently occuring throughout the country? List the pages of the wording that support your conclusion. Provide an executive summary. What in this bill will protect American Citizens from ICE Harrassment? Are there any laws in effect that will protect American citizens from ICE harrassment?

ChatGPT said:

Executive Summary: Impact of the One Big Beautiful Bill Act on ICE Raids

If enacted, the One Big Beautiful Bill Act would significantly expand the operational capacity and authority of U.S. Immigration and Customs Enforcement (ICE), making an increase in the frequency and scale of ICE raids highly likely. The bill allocates billions in new funding, boosts staffing, and reduces legal and logistical constraints on immigration enforcement. It also incentivizes state and local cooperation with ICE.

Key Impacts

Increased Funding: Over $29.85 billion is appropriated for ICE through FY2029, earmarked for hiring, enforcement, and deportations.

Personnel Expansion: New authorities and funding to recruit and rehire ICE agents, including signing and retention bonuses.

Operational Scaling: Significant investments in transportation, detention, and enforcement logistics will support large-scale raids.

Broader State/Local Involvement: Expansion of 287(g) agreements enables more local law enforcement agencies to collaborate with ICE.

Detention Growth: $45 billion allocated to increase detention capacity for both families and individuals.

Legal Streamlining: Dedicated resources for expedited removal proceedings under sections 235(b)(1) and 235(c) of the INA.

Punishment for Non-Cooperation: States or municipalities that restrict ICE operations may lose federal assistance.

Relevant Bill Pages

Pages 904–909 – ICE funding, hiring, and enforcement expansion

Pages 912–913 – Detention capacity funding

Page 909 – Expansion of 287(g) agreements

Page 916 – Federal penalties for state/local non-cooperation

Conclusion: This bill, if passed, would supercharge ICE operations nationwide, directly supporting and likely increasing the volume and scope of immigration enforcement raids.

The One Big Beautiful Bill Act does not include explicit protections for American citizens from harassment, wrongful detention, or overreach by U.S. Immigration and Customs Enforcement (ICE). It primarily focuses on expanding ICE's authority, personnel, funding, and operational capacity, with no parallel set of civil liberties safeguards or due process protections aimed at preventing the mistreatment of citizens.

Relevant Sections Without Protections

Pages 904–909 – Appropriates $29.85 billion for expanded ICE enforcement with no civil oversight language.

Page 909 – Expands 287(g) agreements allowing state/local enforcement of immigration law, again with no civilian complaint or review processes.

Pages 912–916 – Increases funding for detention and prosecution of aliens, but without safeguards to prevent wrongful actions against citizens.

Conclusion

The bill strengthens enforcement but does not include any specific protections to prevent American citizens from being mistakenly targeted or harassed by ICE. If citizen safeguards are a concern, they would need to be added via amendment or addressed in separate legislation.

Several existing laws and constitutional protections already provide some protection for American citizens against harassment, wrongful detention, or deportation by ICE, although enforcement and accountability can vary. Here's a breakdown:

🔒 Key Legal Protections for American Citizens

1. U.S. Constitution

Fourth Amendment – Protects against unreasonable searches and seizures. ICE must have probable cause or a valid warrant to detain a citizen.

Fifth and Fourteenth Amendments – Guarantee due process, meaning the government cannot detain or deport citizens without proper legal procedures.

Sixth Amendment – Guarantees the right to legal counsel in criminal proceedings (though not immigration proceedings, which are civil, not criminal).

2. Immigration and Nationality Act (INA)

While the INA provides authority to remove non-citizens, it does not authorize ICE to detain or deport U.S. citizens. Doing so violates federal law and is unconstitutional.

3. Civil Rights Act of 1871 (42 U.S.C. § 1983)

Allows individuals, including U.S. citizens, to sue government agents—including ICE officers—for violating constitutional rights under the color of law.

4. Bivens Actions (Federal Tort Claims)

Citizens can sue federal agents (like ICE) for constitutional violations in certain cases, especially illegal detention or use of excessive force.

5. ICE Policy Guidelines (internal, not law)

ICE has had internal memos that discourage enforcement actions in sensitive locations (e.g., schools, churches, hospitals). However, these are non-binding and can be rescinded or ignored.

⚠️ Known Gaps and Risks

Despite these protections:

Wrongful detentions have occurred: Multiple documented cases exist of U.S. citizens being mistakenly detained or even deported.

ICE is not required to provide immediate access to legal counsel, especially in early stages of questioning or detainment.

ICE agents do not need a warrant signed by a judge to enter private property if they believe a removal is authorized, unless the target is a citizen or they are challenged.

✅ What Citizens Can Do

Know your rights: Do not open the door unless presented with a judicial warrant. You do not have to answer ICE questions about immigration status if you're a U.S. citizen.

Request legal counsel if detained.

Document the encounter if safe to do so.

File a complaint with DHS Office for Civil Rights and Civil Liberties (CRCL) or sue under 42 U.S.C. § 1983 or the Federal Tort Claims Act.

Summary

Yes, American citizens are legally protected from ICE harassment under the Constitution and civil rights laws. However, practical enforcement of those protections can be inconsistent, and wrongful detentions still happen. The One Big Beautiful Bill Act, as discussed earlier, does not expand or reinforce those protections.

Workplace Safety

You said:

What affect would this bill have on workplace safety if passed?

ChatGPT said:

Impact of the One Big Beautiful Bill Act on Workplace Safety

Based on a thorough review of the bill, there are no direct provisions in the One Big Beautiful Bill Act that strengthen or expand federal workplace safety protections. Specifically, the bill:

⚠️ Does Not Increase OSHA Authority or Funding

The bill contains no new funding or regulatory authority for the Occupational Safety and Health Administration (OSHA) or equivalent worker protection agencies.

There are no provisions mandating enhanced workplace safety inspections, reporting standards, or employer accountability measures.

📉 Indirectly Reduces Oversight and Environmental Safety Standards

The bill rescinds funding from several environmental and health-related programs that can affect workplace conditions, especially in industrial sectors:

Rescinds funds from environmental health programs aimed at reducing emissions and pollution in workplaces and schools.

Eliminates grants for greenhouse gas monitoring, air pollution controls, and low-emission technologies that impact industrial safety.

→ See Sections 60005–60022 of the bill

🔄 Work Requirements and Labor Participation

While unrelated to direct workplace safety, the bill requires certain individuals to work or engage in "community engagement" to qualify for public benefits:

Individuals must work at least 80 hours/month, participate in community service, or meet minimum income thresholds.

These requirements could increase participation in low-wage or gig economy jobs, which statistically have higher rates of workplace hazards and fewer protections.

→ Pages 680–682

✅ Neutral or Potentially Supportive Indirect Effects

The bill expands credentialing and workforce education programs (Workforce Pell Grants, career training), which could improve training and reduce unqualified labor in certain fields. However, these are not tied to safety-specific outcomes.

→ Pages 805–810

Conclusion

The bill does not enhance workplace safety protections and may indirectly weaken environmental and industrial health standards by defunding key initiatives. Combined with expanded work requirements for benefit eligibility, this may place more individuals in hazard-prone jobs with fewer protections, without accompanying reforms to oversight or worker safety enforcement.

Impact on parks

You said:

how would this bill impact parks?

ChatGPT said:

Impact of the One Big Beautiful Bill Act on Parks

The One Big Beautiful Bill Act would have mixed effects on parks and public lands, combining rescissions of environmental and land management funds with targeted appropriations for specific commemorative purposes.

📉 Negative Effects on Park and Public Land Resources

1. Rescission of National Park Service (NPS) and Bureau of Land Management (BLM) Funds

The bill rescinds unobligated funds from several Inflation Reduction Act (IRA) programs previously dedicated to National Parks and BLM conservation and restoration efforts.

→ Rescinded sections include IRA Sections 50221, 50222, and 50223.

2. Increased Development and Timber Extraction on Public Lands

Requires the Forest Service and BLM to increase timber sales annually through at least 2034, potentially affecting national forests and public recreation lands.

→ Includes provisions for long-term logging contracts of 20 years or more.

3. Accelerated Land Disposal

Mandates the sale of BLM land for housing in 11 western states, potentially reducing open space and recreational lands near growing communities.

→ Land must not be part of the National Park System, but its loss may impact ecosystem connectivity or adjacent recreational lands.

✅ Positive or Neutral Provisions

1. Commemoration of America’s 250th Anniversary

Provides $150 million to the National Park Service for events, celebrations, and public programming related to the U.S. Semiquincentennial (250th anniversary).

→ Funds are appropriated through FY2028 and designated for cultural and educational activities.

2. Reinvestment in BLM Recreational Amenities

Directs 10% of proceeds from federal land sales to be reinvested in hunting, fishing, and recreation amenities on BLM land, and to reduce deferred maintenance.

→ This provides some offset for lost land through targeted reinvestment.

Summary

Impact AreaEffectNational Park Conservation Funding🔻 Rescinded via repeal of IRA allocationsPublic Land Logging🔺 Required increase in timber harvest annuallyBLM Land Availability🔻 Reduction due to mandatory sales for housingCommemorative Programming (NPS)✅ $150M for America’s 250th Anniversary eventsRecreational Infrastructure on BLM Lands⚖️ 10% of land sale proceeds for recreation upkeep

Conclusion: The bill cuts park conservation funding, increases land development pressures, and prioritizes resource extraction, but does include limited reinvestment in cultural celebrations and BLM recreation facilities.

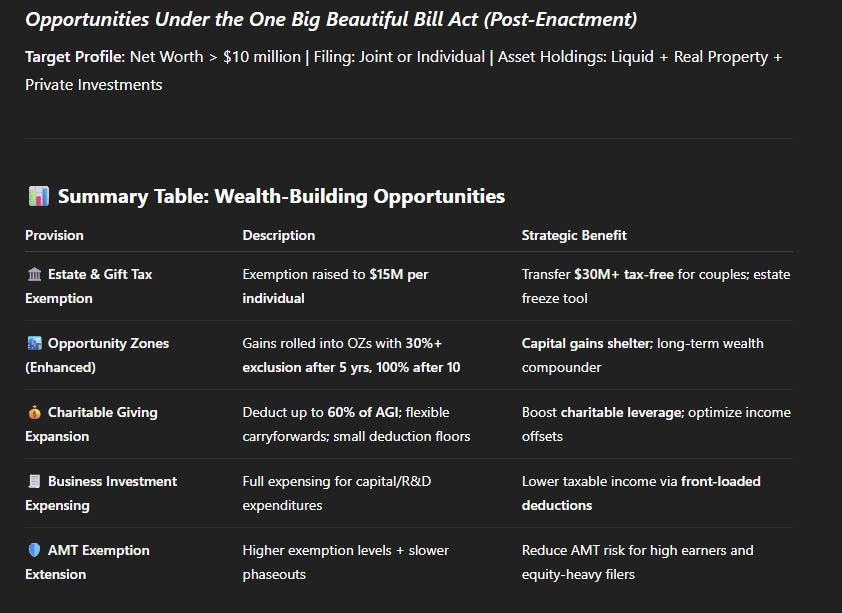

Opportunities for rich people to get richer

You said:

What opportunities for self enrichment would this bill offer for people currently worth more than $10 million? Summarize formatted as a high-net-worth client advisory

ChatGPT said:

Here is a High-Net-Worth Client Advisory Summary of the One Big Beautiful Bill Act, formatted for easy strategic review:

🧠 Strategic Takeaways

Intergenerational Wealth: Use the expanded estate exemption to set up irrevocable trusts or SLATs (Spousal Lifetime Access Trusts).

Capital Gains Planning: Liquidate appreciated assets tax-deferred through Opportunity Zones; pair with Qualified Opportunity Funds (QOFs).

Charitable Offsets: Bundle donations in high-income years or establish Donor-Advised Funds (DAFs) to front-load deductions.

Corporate Structuring: Real estate and R&D-heavy businesses should consider pass-through structures to maximize Section 179 & expensing.

AMT Minimization: Shift income into AMT-optimized vehicles like tax-free bonds or non-AMT-triggering capital gains.

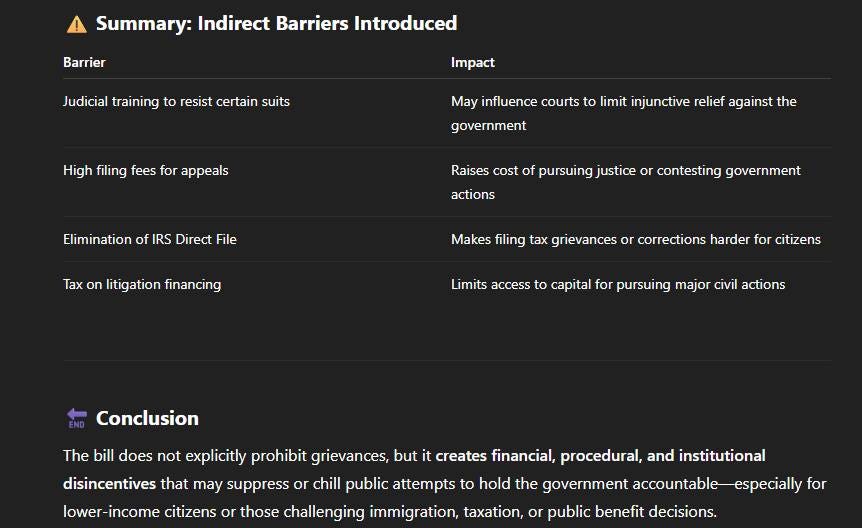

Government Grievance

You said:

What barriers would this bill put in front of the average citizen who wishes to file a grievance against the government?

ChatGPT said:

Potential Barriers to Filing Grievances Against the Government Under the One Big Beautiful Bill Act

While the bill does not outright ban or restrict the constitutional right to petition the government or access the courts, it introduces several indirect barriers—legal, procedural, and financial—that may discourage or burden the average citizen seeking to file a grievance or lawsuit against the federal government.

🔚 Conclusion

The bill does not explicitly prohibit grievances, but it creates financial, procedural, and institutional disincentives that may suppress or chill public attempts to hold the government accountable—especially for lower-income citizens or those challenging immigration, taxation, or public benefit decisions.

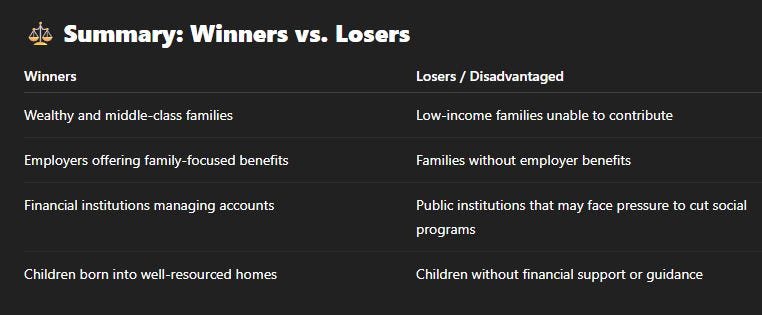

Who benefits the most and who is harmed the most

You said:

Describe the person who would be most negatively impacted by this bill and describe the person who would be most positively impacted by this bill. Compare and contrast the effects of this bill on those two individuals. Provide an executive summary outlining the basic impacts.

ChatGPT said:

Executive Summary: Contrasting the Most Negatively and Positively Impacted Individuals Under the One Big Beautiful Bill Act

The One Big Beautiful Bill Act would deepen the divide between high-net-worth individuals and low-income citizens by providing expansive financial and tax opportunities for the wealthy, while imposing new eligibility restrictions and increased burdens on the poor. Below is a detailed comparison of the two extremes.

👤 Most Negatively Impacted Individual

Profile

Income: ~$18,000/year

Status: Single parent, Head of Household

Employment: Part-time retail worker

Dependents: 2 children

Relies on: Medicaid, SNAP, ACA premium subsidies, Child Tax Credit

Housing: Rents apartment, receives some housing assistance

Education: High school diploma

Key Negative Impacts

AreaImpactMedicaidRisk of losing coverage if not meeting 80-hour work requirementOut-of-pocket costsFaces new cost-sharing for Medicaid services (up to 5% of income/quarter)SNAP benefitsFlat benefit levels, even if food costs rise (due to “cost neutrality”)Childcare/HealthMay lose ACA premium subsidies if disqualified under new criteriaTax FilingLoses free IRS Direct File, faces prep feesLegal AccessMust pay $900+ for appeals in some benefit cases

🧑💼 Most Positively Impacted Individual

Profile

Net Worth: $15+ million

Income: $1.5 million/year from business & investments

Employment: Owner of a tech company with real estate holdings

Family Status: Married, no minor dependents

Healthcare: Private coverage

Investment Strategy: Uses Opportunity Zones, trusts, and pass-through entities

Key Positive Impacts

AreaImpactEstate PlanningEstate tax exemption increased to $15M per personCapital Gains ShelterCan use Opportunity Zones to exclude large capital gains from taxationBusiness InvestmentGains full expensing for R&D and capital expendituresCharitable DeductionsCan deduct up to 60% of AGI for giving, supporting philanthropic brandingAMT ReliefHigher exemption reduces exposure to Alternative Minimum Tax

⚖️ Conclusion

The bill would materially enrich high-net-worth individuals through wealth protection and investment incentives, while placing greater administrative, financial, and legal burdens on economically vulnerable Americans.

What is a Trump account

You said:

Describe a "Trump Account" and how it is similar or different from other existing types of accounts.

ChatGPT said:

What Is a “Trump Account”?

A Trump Account is a newly proposed tax-advantaged savings account introduced in the One Big Beautiful Bill Act. It is structured like a traditional IRA but is created and funded primarily for individuals under the age of 18, with special rules for contributions, distributions, and tax treatment.

💬 Summary

A Trump Account is a youth-focused savings tool with retirement-style tax advantages and a built-in pilot program to seed accounts with federal funds. It differs from IRAs and 529s in that:

It is automatically created or facilitated by the government,

It limits use and withdrawals until adulthood,

It allows employer and general contributions to be excluded from income, and

It is tailored to early investment education and savings accumulation for children.

You said:

what is the purpose of a trump account? How would it be used to benefit the average citizen?

ChatGPT said:

Purpose of a Trump Account

The Trump Account, as introduced in the One Big Beautiful Bill Act (Section 70204), is designed to function as a government-supported, tax-advantaged savings account primarily for children under the age of 18. Its stated purpose is to encourage long-term saving and investing early in life, helping young Americans accumulate wealth from childhood into adulthood.

🎯 Primary Goals of the Trump Account

Promote Generational Wealth Building

→ By starting accounts for children early, the bill aims to give families a tool to grow savings through tax-deferred investment.Encourage Private Saving Over Public Dependency

→ The account structure reflects the bill’s ideological preference for private capital accumulation over social benefits.Foster Financial Literacy and Investment Habits

→ Families and employers can contribute to these accounts, ideally instilling habits of saving, long-term thinking, and capital investment in children.Enable Wealth Transfer and Seeded Investment

→ The optional $1,000 refundable credit (2025–2028 pilot) creates “baby bond”-style seed money for children born during this period, particularly if expanded nationally.

💵 How It Could Benefit the Average Citizen

ScenarioPotential BenefitLow-income parentsCould receive $1,000 seed deposit per child (pilot program), helping start a savings baseWorking families with young childrenCan contribute up to $5,000/year per child with tax-deferred growthEmployers contributing on behalf of childrenUp to $2,500/year employer contribution excluded from employee incomeChildren investing earlyPotential for decades of compounded investment growth before withdrawals beginRollovers for disability or educationMay allow special-purpose rollovers to ABLE or education accounts (subject to rules)

⚠️ Limitations and Caveats

Not automatically funded for all unless included in the pilot credit.

Withdrawals before age 18 are limited, and may be restricted unless for rollovers.

Benefit skews toward families who can afford to contribute regularly—those living paycheck to paycheck may be unable to take full advantage.

Does not replace other safety nets like 529 plans or health savings accounts (HSAs).

✅ Bottom Line

The Trump Account is intended as a long-term wealth-building tool for children, offering average families a new tax-favored way to save. Its core benefit lies in compound growth over time, particularly when seeded at birth or early childhood. However, its usefulness depends heavily on a family’s ability to contribute regularly, which may limit its accessibility to lower-income households unless the pilot program is made universal or expanded.

You said:

who would benefit from the creation of a trump account? Would anyone be negatively impacted by the creation of a trump account?

ChatGPT said:

Who Would Benefit from the Creation of a Trump Account?

The Trump Account, as proposed in the One Big Beautiful Bill Act (Section 70204), is designed to create long-term financial advantages through tax-deferred savings for youth. However, the benefits are not evenly distributed. Those with financial capacity and access to investment literacy benefit most, while others may be structurally left out.

✅ Groups That Would Most Benefit

1. Upper- and Middle-Income Families with Young Children

Can afford to contribute up to $5,000/year per child (indexed).

Benefit from tax-deferred growth similar to IRAs.

Already have the financial and logistical capacity to use the account efficiently.

May use it in conjunction with other tools like 529 plans, Roth IRAs for kids, or trusts.

2. Employers Offering Family Benefits

Can contribute up to $2,500 per child per year, tax-free for the employee.

Could attract talent by offering Trump Account contributions as a benefit.

Reduces employer payroll tax liability due to excluded compensation.

3. Financial Institutions and Investment Managers

If allowed to manage Trump Accounts, banks, brokerages, and ETF providers could gain new retail accounts and capital flows, especially if accounts are defaulted into specific low-cost funds.

4. Children Born During the Pilot Period (2025–2028)

May receive a $1,000 refundable federal credit into a Trump Account—essentially free capital.

Could see decades of compounding if invested well.

❌ Who Might Be Negatively Impacted or Left Out?

1. Low-Income Families Unable to Contribute

Families living paycheck to paycheck may lack the resources to contribute, thus missing out on growth.

Children in these households could fall further behind wealthier peers over time if the accounts become widespread.

2. Families Without Financial Literacy or Access

Households unfamiliar with investing may not fully understand or trust how to use the account.

Could be influenced into misusing funds (if early withdrawal rules are loosened over time).

3. Public Benefit Program Administrators

The creation of the Trump Account reflects a shift toward private savings and away from public benefits, which could increase pressure to reduce or replace traditional aid programs (e.g., food assistance, college grants).

4. Taxpayers Concerned About Equity

Critics may view the Trump Account as another tax-advantaged vehicle favoring the wealthy, like IRAs or HSAs, while offering minimal benefit to the lowest-income Americans without broader funding.

🧭 Conclusion

The Trump Account has the potential to create meaningful long-term value for children whose families can contribute consistently. However, it does little to directly address wealth inequality unless accompanied by universal funding or structural equity safeguards. Without those, it may widen the gap between families who can invest early and those who cannot.

Would you like a policy proposal to make Trump Accounts more equitable?